VISION 2023 - CCCNZ Member Survey Report

In its 3rd consecutive year, the CCCNZ Annual Member Business Survey in the New Zealand based on responses from 123 companies and contributive interviews. In a complex, changing, and increasingly contested environment, the business operations and investments of CCCNZ Members in NZ outlined a mixed picture of slightly recovered performances and mounting uncertainties bred by the tumultuous circumstances throughout 2022.

[About the Survey]

First of all, we wanted to get to know our own members better to identify their needs. The CCCNZ members survey is an annual snapshot of our members' views of their business and the general business environment. Most of the questions refer to how businesses expect future events to unfold, which is forward-looking in nature. Specifically, this year's survey is used first to measure business confidence and resilience in the post-pandemic economic environment, second to assess members' perceptions of the China-New Zealand Economic and Trade Cooperation, and last but not least, to assess members' awareness levels and perceptions of a range of Regional Economic and Trade Cooperation agreements. In the future, we will track how those views might change or impact business performance.

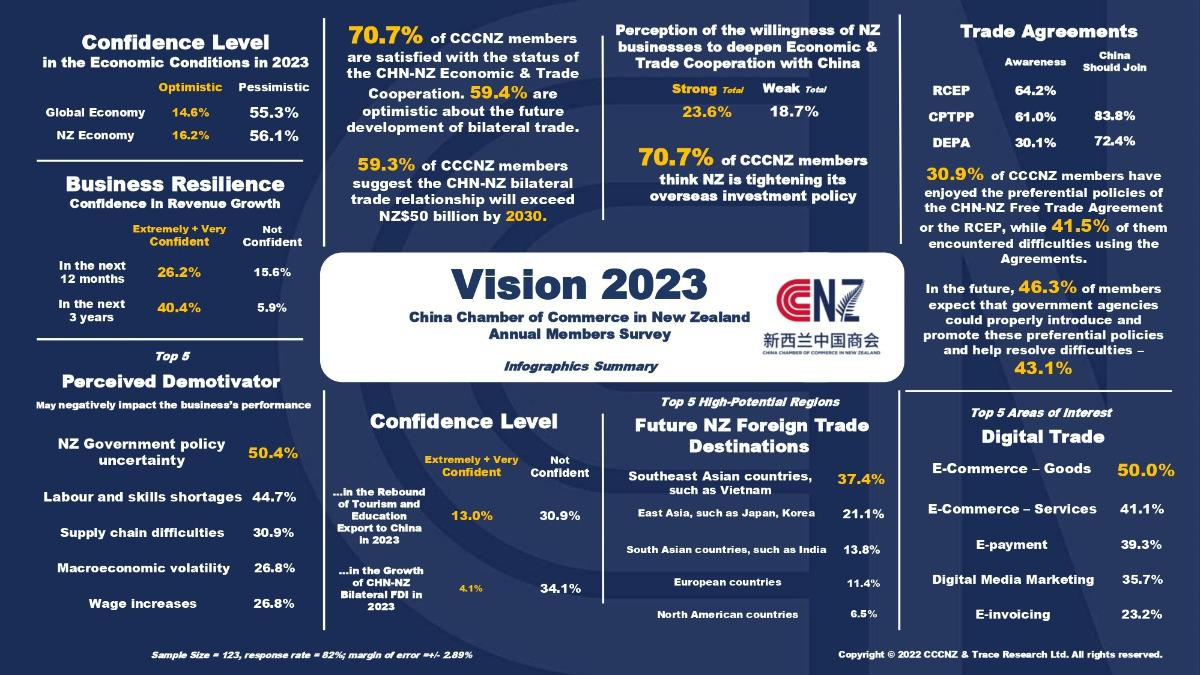

This slide summarises all the key findings from the survey. I will briefly present the results on business confidence and resilience in the post-pandemic economic environment, and our panellists will cover the other two main topics in the following sessions. Thanks to the 123 members who participated in this survey, which resulted in an 82% response rate. Your contributions are greatly appreciated.

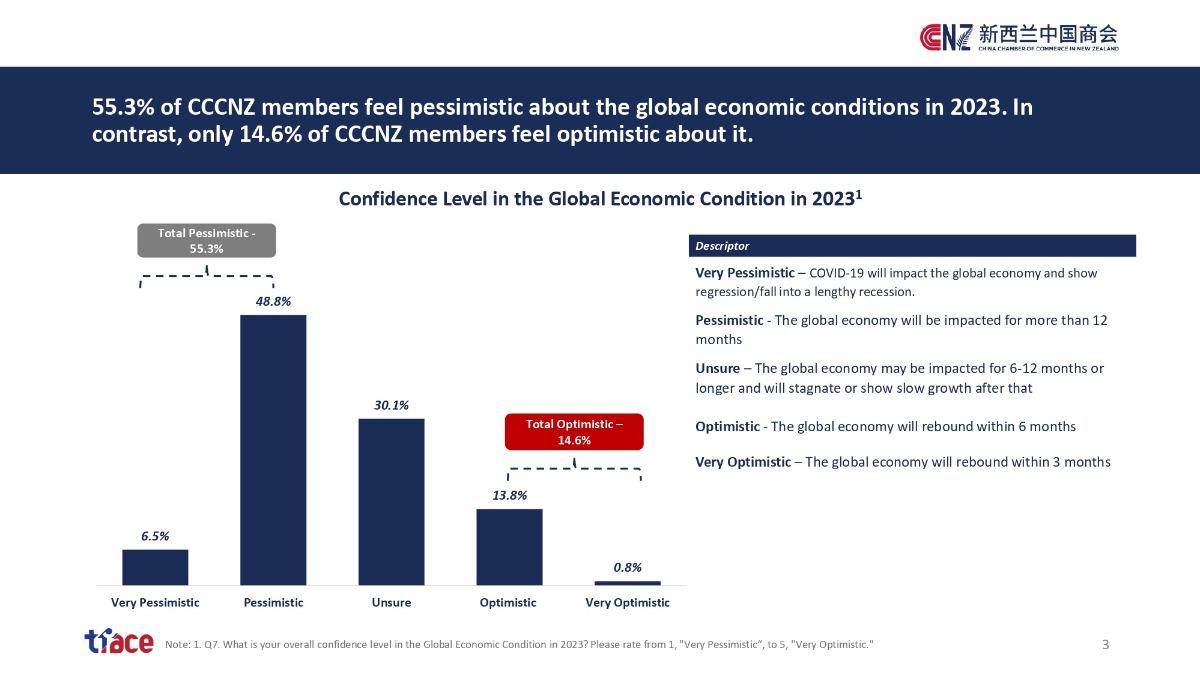

Our survey finds that 55.3% of members feel pessimistic about the global economic conditions in 2023, which means most of our members believe the global economy will be impacted for at least another 12 months. In contrast, only 14.6% of members feel optimistic about it and believe the global economy will rebound in less than 6 months.

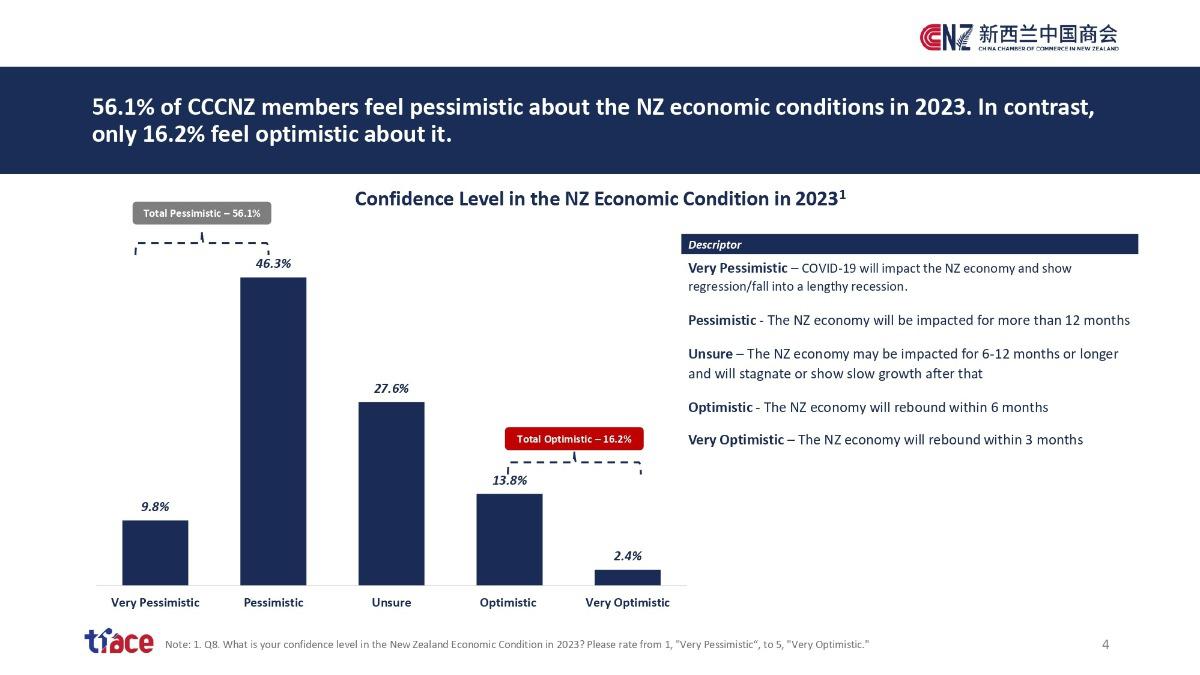

When asked about the confidence level of the NZ economy, 56.1% of our members feel pessimistic about the NZ economic conditions in 2023. In contrast, only 16.2% feel optimistic about it.

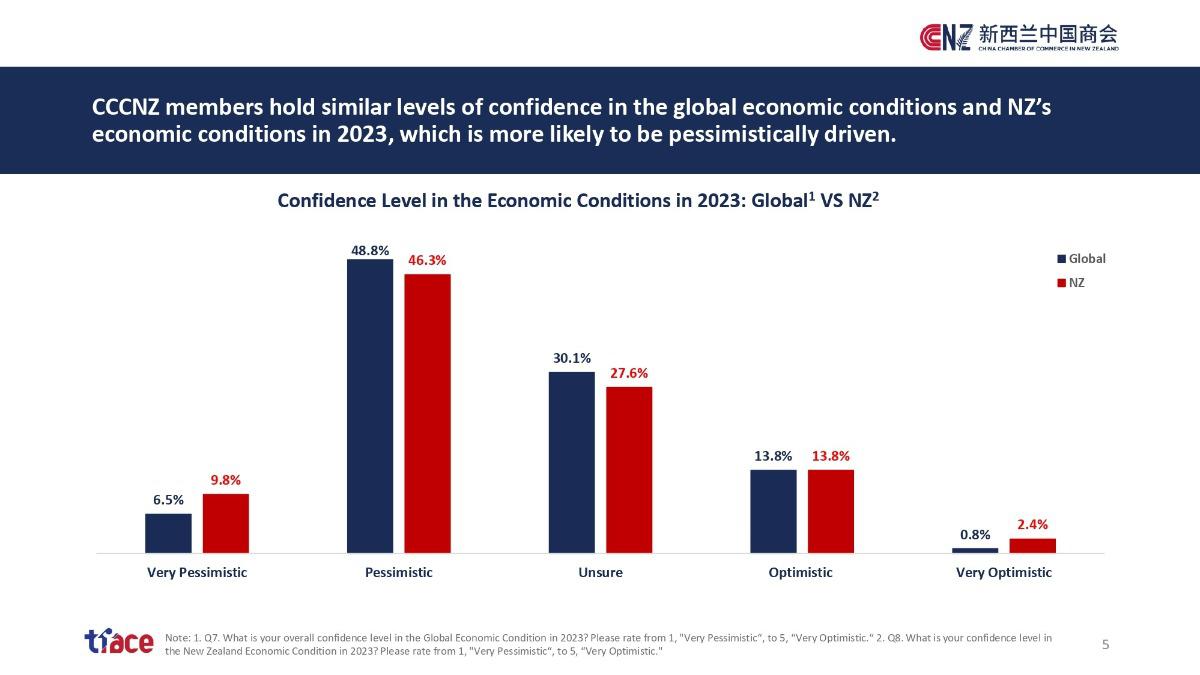

When compared, our members hold similar levels of confidence in the global and NZ economic conditions in 2023, which is more likely to be pessimistically driven.

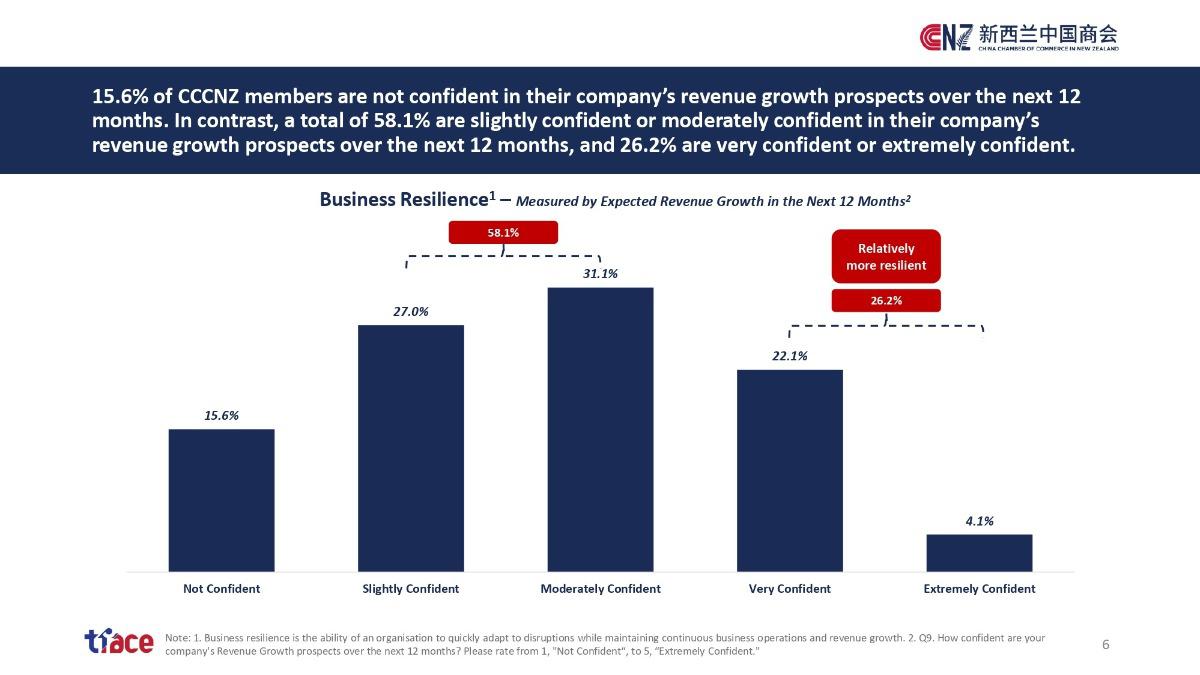

Business resilience is the ability of an organisation to adapt quickly to disruptions while maintaining continuous business operations and revenue growth. Our survey measured business resilience through the lens of "expected revenue growth" in 12 months versus 3 years. The results show that 15.6% of members are not confident in their company's revenue growth over the next 12 months. In contrast, a total of 58.1% are slightly or moderately confident in their company's revenue growth over the next 12 months, and 26.2% are very or extremely confident.

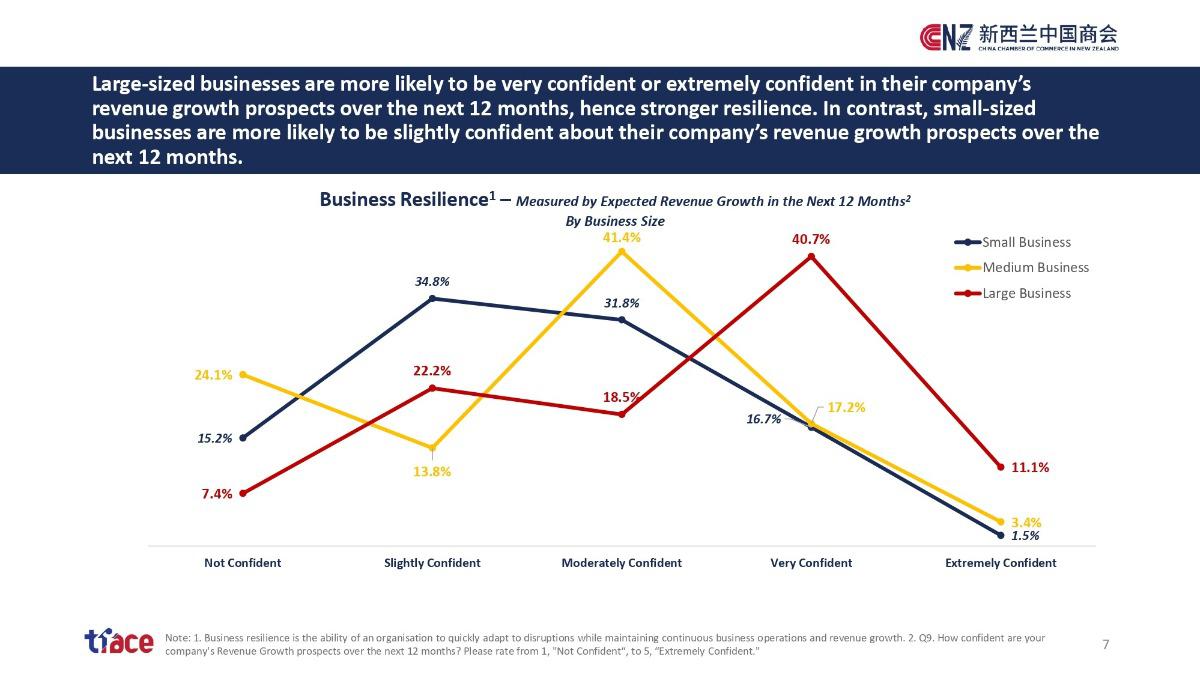

When compared by business size, large-sized businesses are more likely to be very or extremely confident in their company's revenue growth over the next 12 months, hence stronger resilience. In contrast, SMEs are more likely to be not confident or slightly confident about their company's revenue growth, hence weaker resilience or higher vulnerability. Throughout our survey findings, medium-sized business members expressed the most concern regarding their future business prospects, hence the potential need for transformation in their business models.

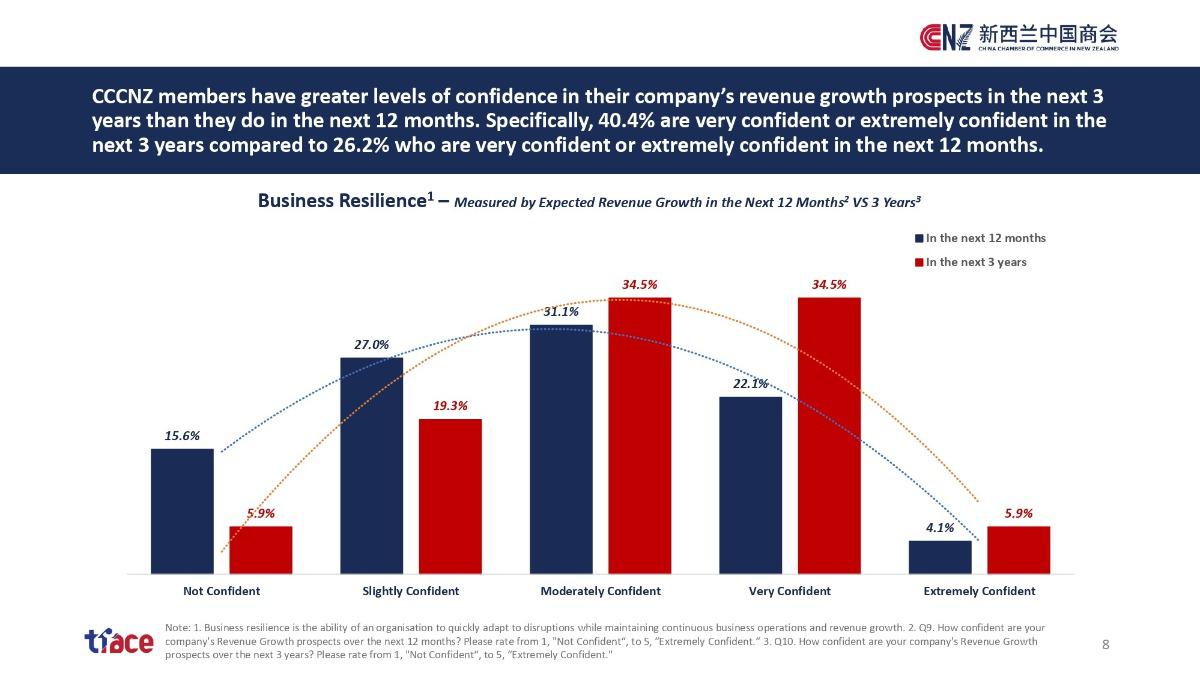

On a positive note, our members have greater confidence in their company's revenue growth prospects in the next 3 years than they do in the next 12 months. Specifically, 40.4% are very or extremely confident in the next 3 years compared to 26.2% who are very or extremely confident in the next 12 months.

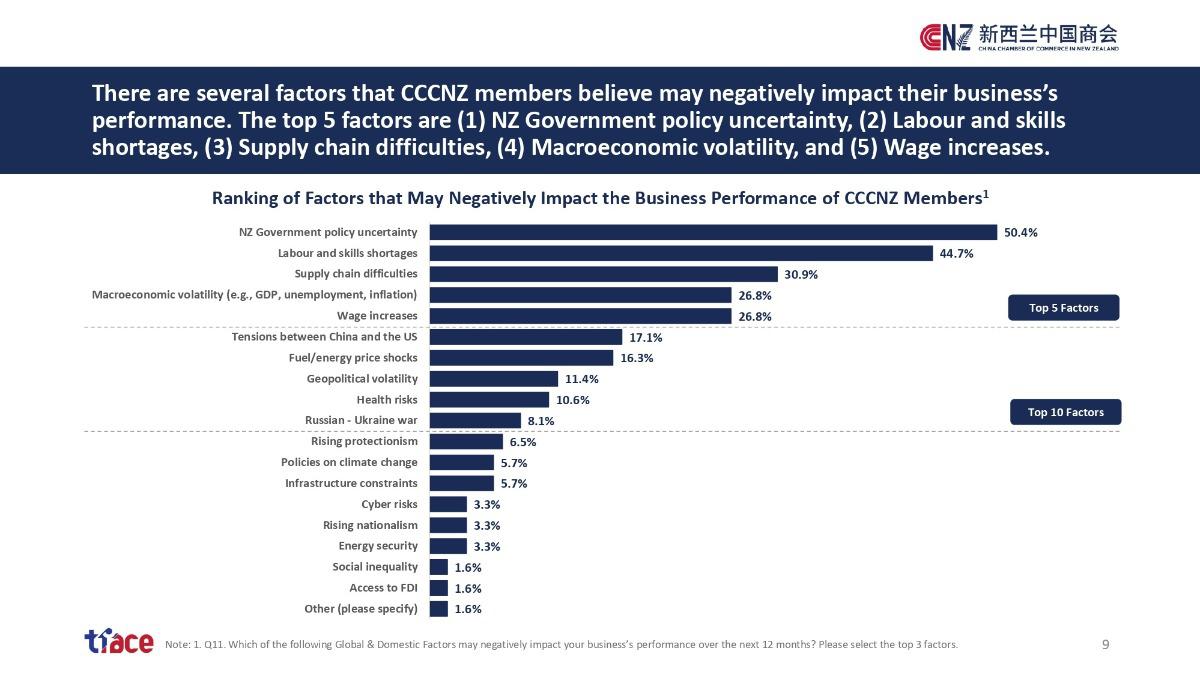

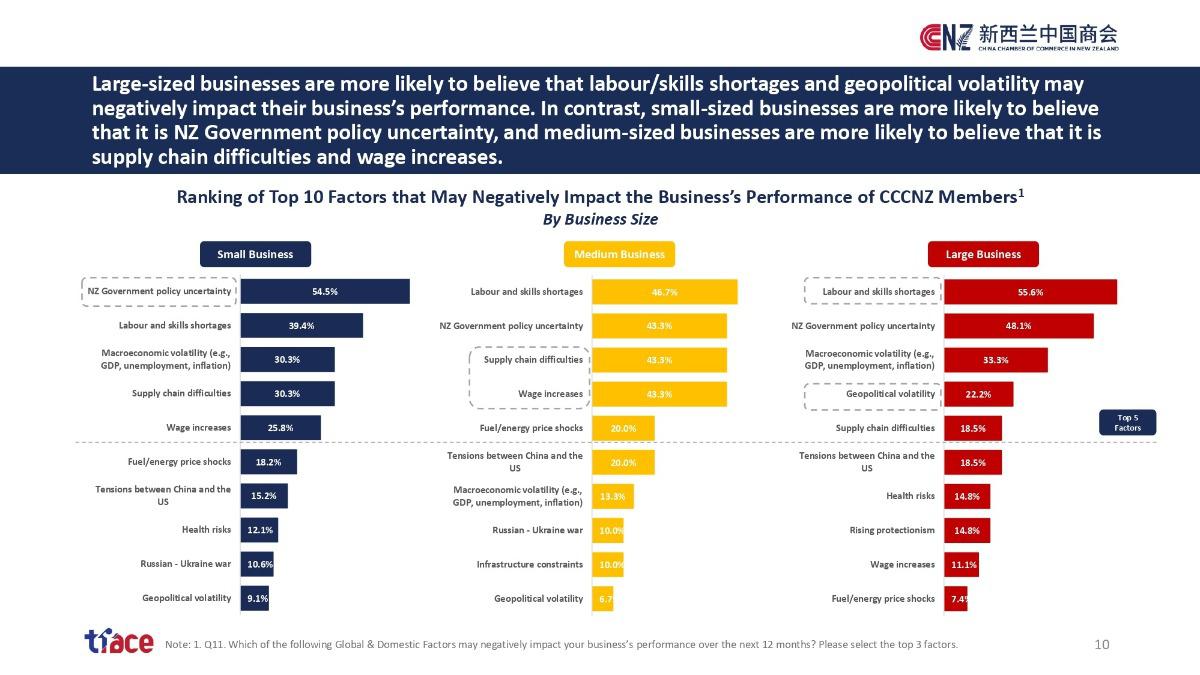

We are curious about the drivers of our members' "pessimistic" view of the economy. Our survey found several factors that our members believe may negatively impact their business's performance in the next 12 months. The top 5 factors are (1) NZ Government policy uncertainty, (2) Labour and skills shortages, (3) Supply chain difficulties, (4) Macroeconomic volatility, and (5) Wage increases.

When compared by business size, large-sized businesses are more likely to believe that labour/skills shortages and geopolitical volatility may negatively impact their business's performance. In contrast, small-sized businesses are more likely to believe that it is NZ Government policy uncertainty, and medium-sized businesses are more likely to believe that it is supply chain difficulties and wage increases.

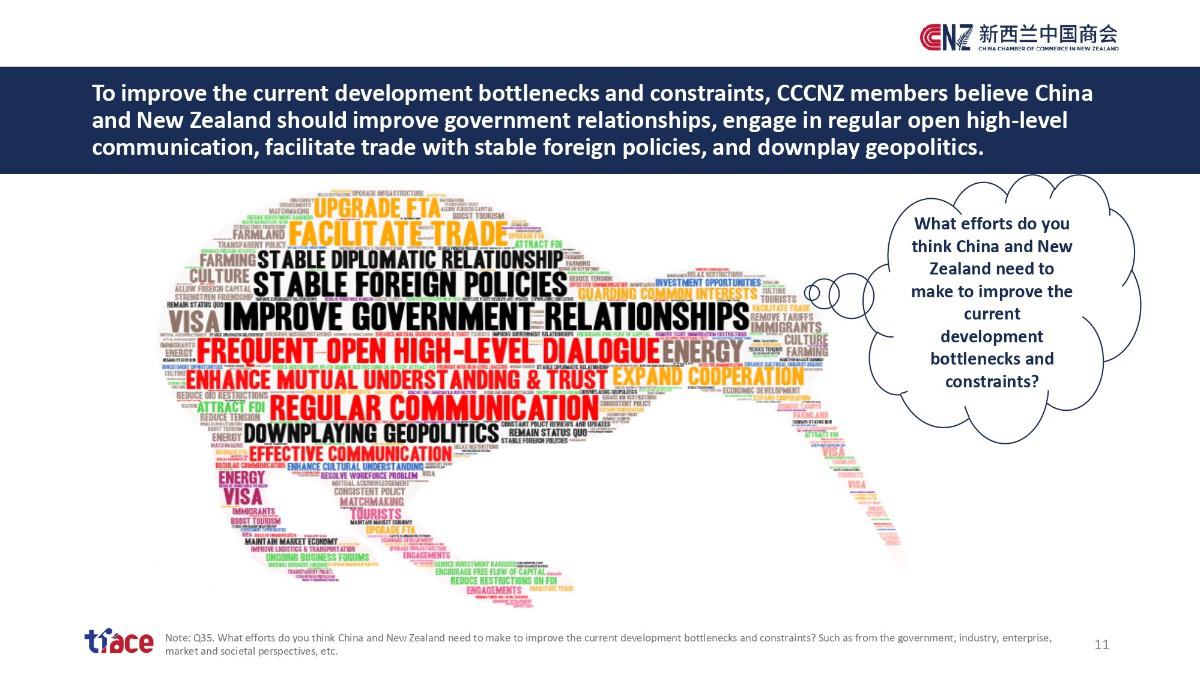

Towards the end of the survey, our members were asked, "What efforts do you think China and New Zealand need to make to improve the current development bottlenecks and constraints?" We received a hundred constructive comments. To improve the current development bottlenecks and constraints, our members believe China and New Zealand should improve government relationships, engage in regular open high-level communication, facilitate trade with stable foreign policies, and downplay geopolitics.

In their own words, members stress the need for a stable bilateral political and economic relationship between the two countries, a high level of mutual trust and a great spirit of cooperation, setting up NZ brands industrial park in China, and the need to try understanding one another's businesses and industries.

END