CCCNZ 2024 MEMBER SURVEY - 新西兰中国商会会员年度调查报告

CCCNZ 年度会员调查,展示了会员对企业和更广泛前景的前瞻性观点。

This year's survey focuses on four key objectives: gauging members' confidence and resilience in the forthcoming economic landscape, evaluating perspectives on bilateral trade between New Zealand and China, investigating obstacles and prospects for future economic and trade cooperation between the two nations, and appraising members' views on the policies and initiatives of the recently established NZ government. This survey offers a profound insight into our esteemed members' economic sentiments and perspectives, providing a roadmap for the future of New Zealand-China economic relations.

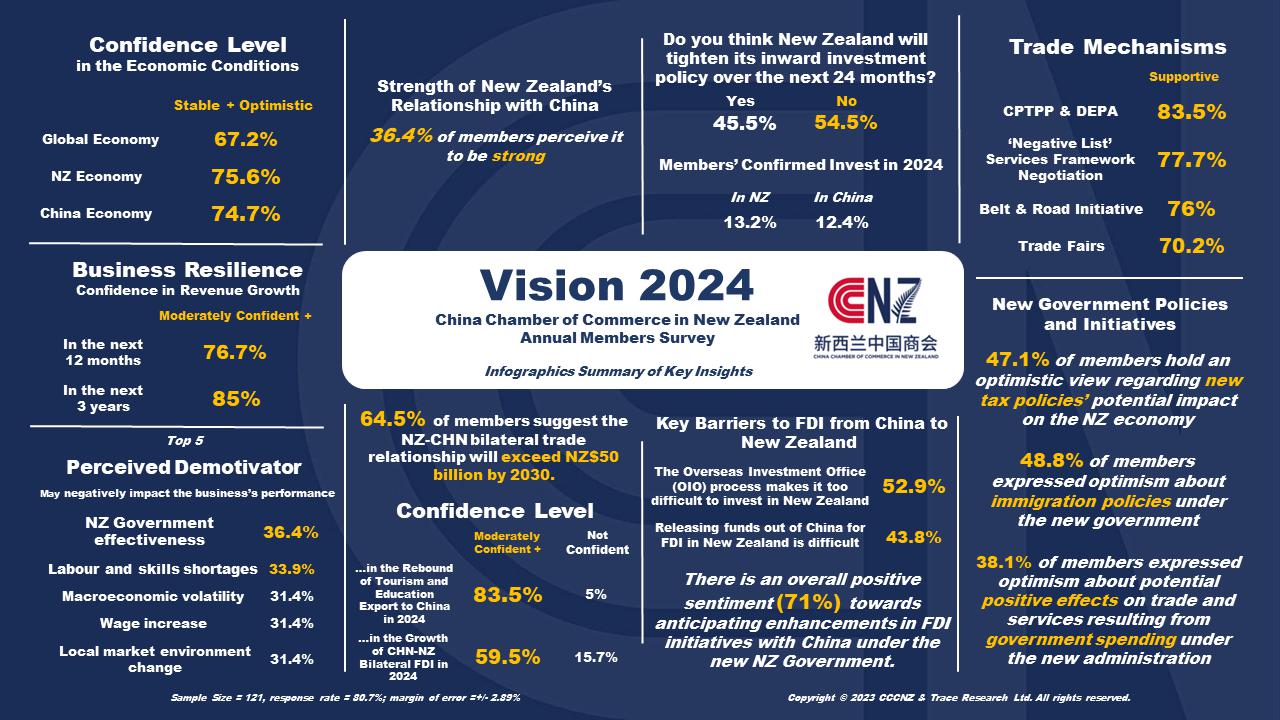

This infographic summarises all the key findings from this survey. I will briefly present the results on business confidence and resilience, and our panellists will cover other surveyed topics in the following sessions. Thanks to the 121 members who participated in this survey, your contributions are greatly appreciated.

今年的调查重点关注四个关键目标:衡量企业对未来经济形势的信心和韧性、评估新西兰和中国双边贸易的前景、调查两国未来经贸合作的障碍和前景,以及评估会员们对最近成立的新西兰联合政府的政策和举措的看法。 这项调查深入洞察了成员的经济情绪和观点,为新中经济关系的未来提供了路线图。

该信息图总结了本次调查的所有主要发现。 感谢参与本次调查的 121 名会员,非常感谢你们的贡献。

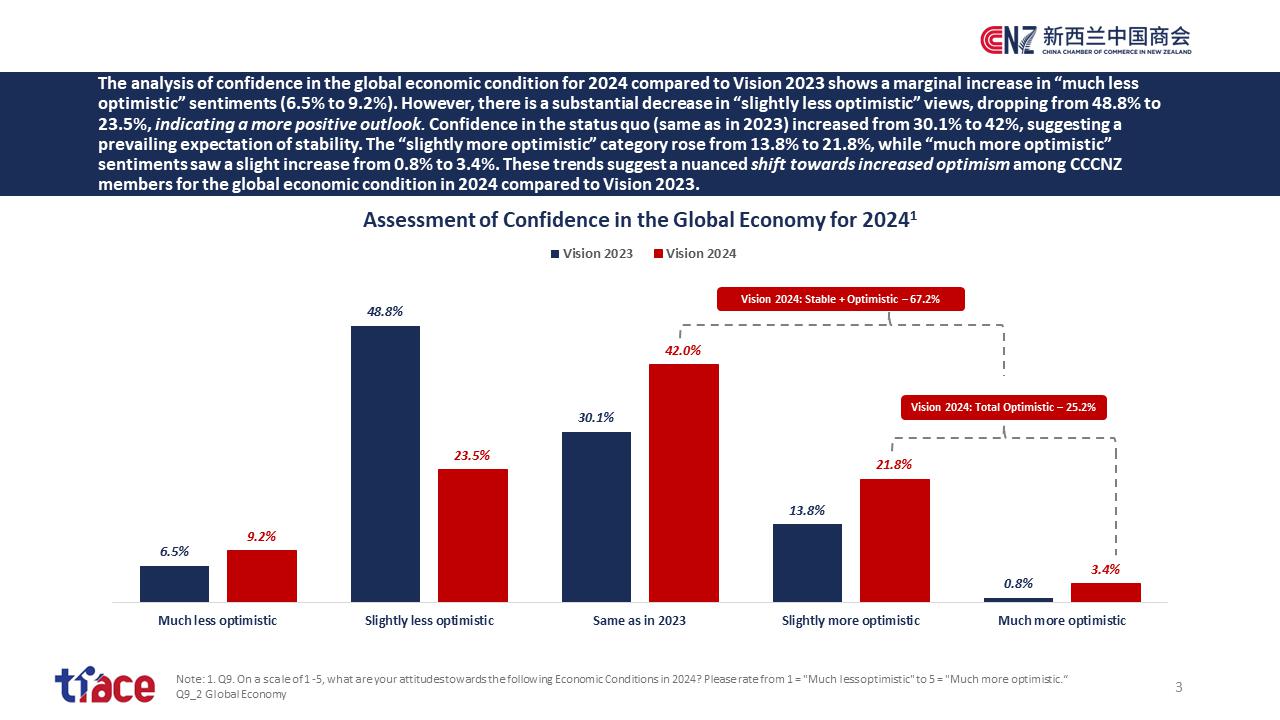

In the global arena, we observe a positive shift in optimism among CCCNZ members. As compared to Vision 2023, notably, there is a substantial decrease in "slightly less optimistic" views, dropping from 48.8% to 23.5%, signaling a more positive perspective. Confidence in the status quo, mirroring the conditions in 2023, has increased from 30.1% to 42%, suggesting an expectation of stability. The "slightly more optimistic" category rose from 13.8% to 21.8%, while "much more optimistic" sentiments experienced a slight uptick from 0.8% to 3.4%. These trends indicate a shift towards heightened optimism among CCCNZ members regarding the global economic condition in 2024 when compared to the outlook envisioned in Vision 2023.

.在全球视角上,我们观察到商会成员的乐观态度发生了积极转变。 值得注意的是,与2022年12月初发布的《2023新西兰中国商会会员调查报告》相比,“不太乐观”的观点大幅下降,从 48.8% 降至 23.5%,表明观点更加积极。 对现状的信心(反映 2023 年的情况)从 30.1% 上升至 42%,表明对稳定的预期。 “稍微乐观”类别从 13.8% 上升至 21.8%,而“更加乐观”情绪则从 0.8% 略有上升至 3.4%。 这些趋势表明,与《2023新西兰中国商会会员调查报告》中设想的前景相比,会员们对 2024 年全球经济状况的乐观态度有所转变。

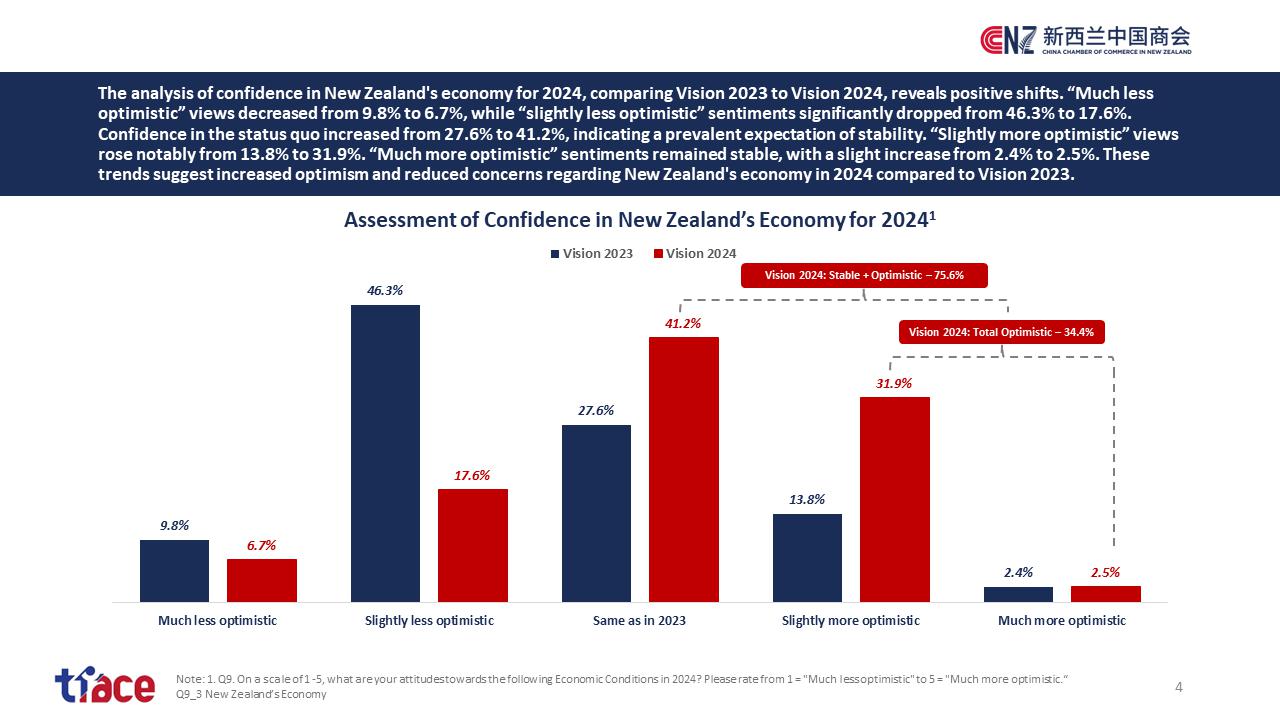

Turning our attention to the local market, members' confidence in New Zealand's economy is a significant positive trend. The percentage expecting economic conditions to remain "same as in 2023" has increased from 27.6% to 41.2%, indicating a more stabilised perception. Additionally, there's a noteworthy increase in those feeling "slightly more optimistic," raised from 13.8% to 31.9%, reflecting heightened optimism.

将我们的注意力转向当地市场,会员对新西兰经济的信心是一个显着的积极趋势。 预计经济状况将保持“与2023年相同”的比例从27.6%上升至41.2%,表明看法更加稳定。 此外,那些感觉“稍微乐观”的人也显着增加,从 13.8% 上升到 31.9%,反映出乐观情绪的增强.

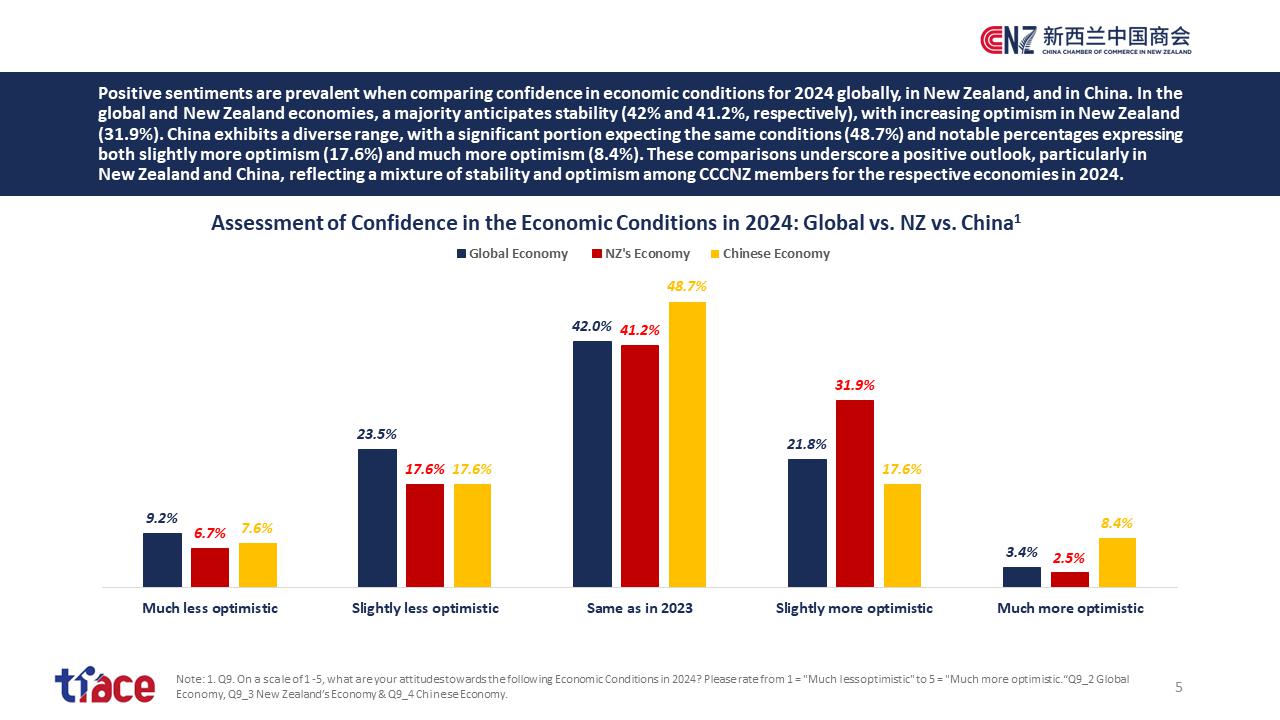

As we have seen the from the previous two slides, positive sentiments are prevalent when comparing confidence in economic conditions for 2024 globally, in New Zealand and China. In the global and New Zealand economies, a majority anticipates stability, with increasing optimism in New Zealand. China exhibits a bell-shaped distribution of sentiments, reflecting a normal distribution, with a significant portion expecting the same conditions and notable percentages expressing slightly more and much more optimism. These comparisons underscore a positive outlook, particularly in New Zealand and China, reflecting stability and optimism among our members for the respective economies in 2024.

正如我们从前两张图表中看到的,在比较新西兰和中国对 2024 年全球经济状况的信心时,积极情绪普遍存在。 在全球和新西兰经济中,大多数人预计稳定,新西兰的乐观情绪日益增强。 中国的情绪呈钟形分布,反映了正态分布,其中很大一部分人预期情况相同,而相当多的人则表达了稍微越来越乐观的态度。 这些比较突显了积极的前景,尤其是新西兰和中国,反映出我们的成员对 2024 年各自经济体的稳定性和乐观态度.

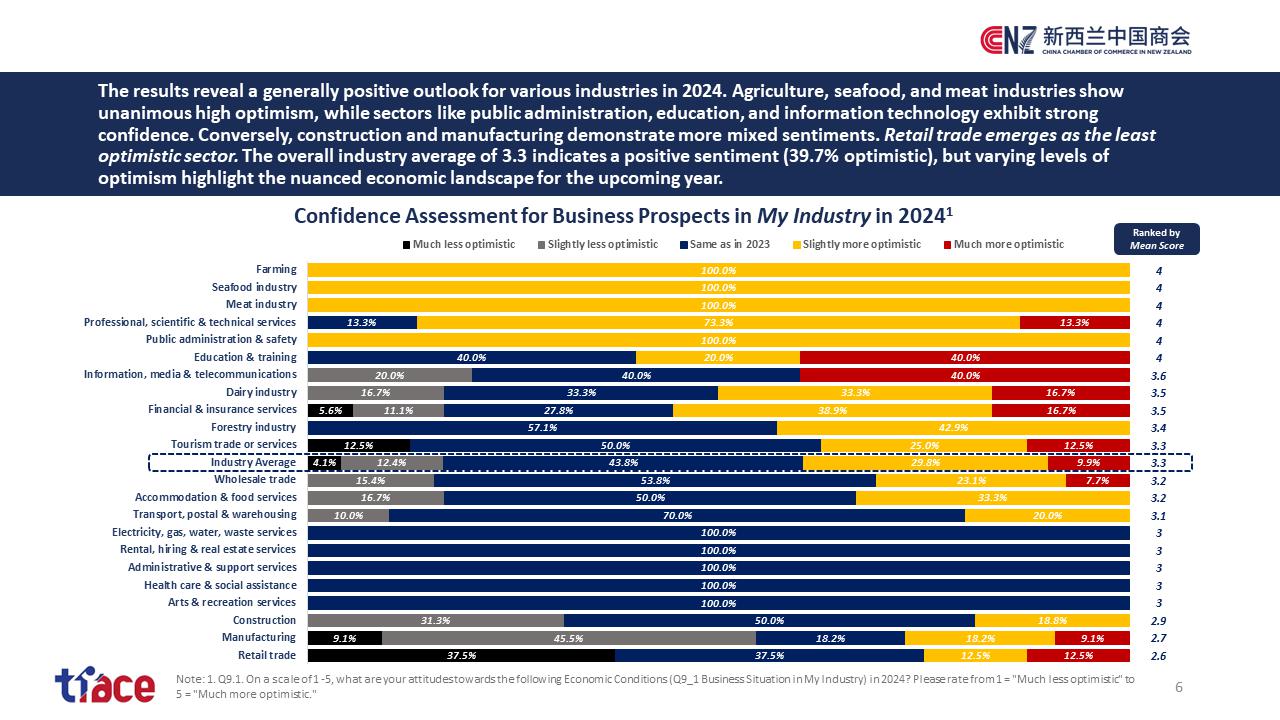

Our industries significantly shape the economic landscape, and when members were surveyed about their confidence in their respective sectors, the results revealed an overall industry average score of 3.3 out of 5, reflecting a positive sentiment. Notably, certain sectors such as agriculture, seafood, and meat showcase robust optimism, while public administration, education, and information technology exhibit strong confidence. However, it's essential to recognize the mixed sentiments within construction and manufacturing and to address the challenges faced by the retail trade sector. This diversity in confidence levels contributes to the variations observed in our overall measures of confidence across industries.

会员行业对经济格局具有重大影响,当对会员们对各自行业的信心进行调查时,结果显示,行业整体平均得分为 3.3 分(满分 5 分),反映出积极的情绪。 值得注意的是,农业、海鲜和肉类等某些行业表现出强烈的乐观情绪,而公共管理、教育和信息技术则表现出强烈的信心。 然而,必须认识到建筑业和制造业内部的复杂情绪,并解决零售业面临的挑战。 这种置信水平的多样性导致了我们在不同行业的总体置信度衡量指标中观察到的差异。

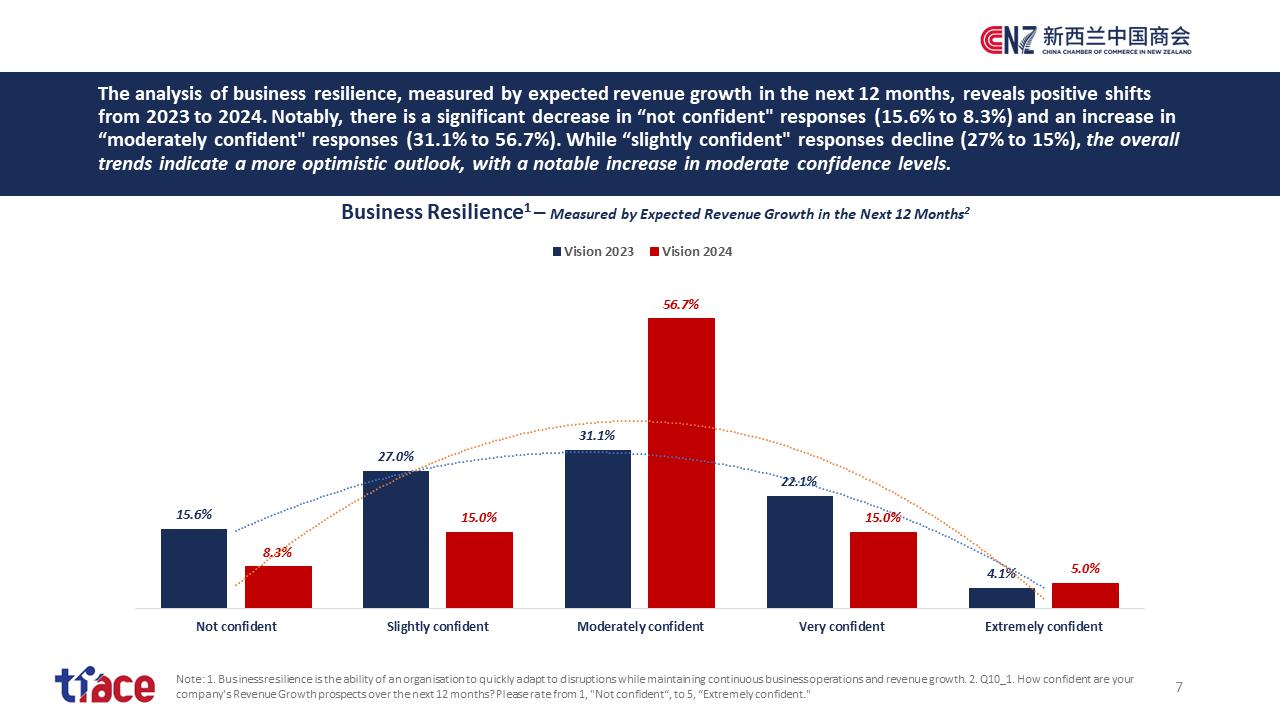

Business resilience is the ability of an organisation to adapt quickly to disruptions while maintaining continuous business operations and revenue growth. The analysis of business resilience, measured by expected revenue growth in the next 12 months, reveals positive shifts from 2023 to 2024. Notably, there is a significant decrease in "not confident" responses (15.6% to 8.3%) and an increase in "moderately confident" responses (31.1% to 56.7%). The overall trends indicate a more optimistic outlook, with a notable increase in moderate confidence levels.

商业弹性是企业快速适应环境变化,同时保持持续业务运营和收入增长的能力。 以未来 12 个月的预期收入增长来衡量的业务弹性分析揭示了 2023 年至 2024 年的积极转变。值得注意的是,“不自信”的回答显着减少(15.6%至 8.3%),而“不自信”的回答则有所增加。 中等信心”的回答(31.1% 至 56.7%)。 总体趋势表明前景更加乐观,适度信心水平显着上升。

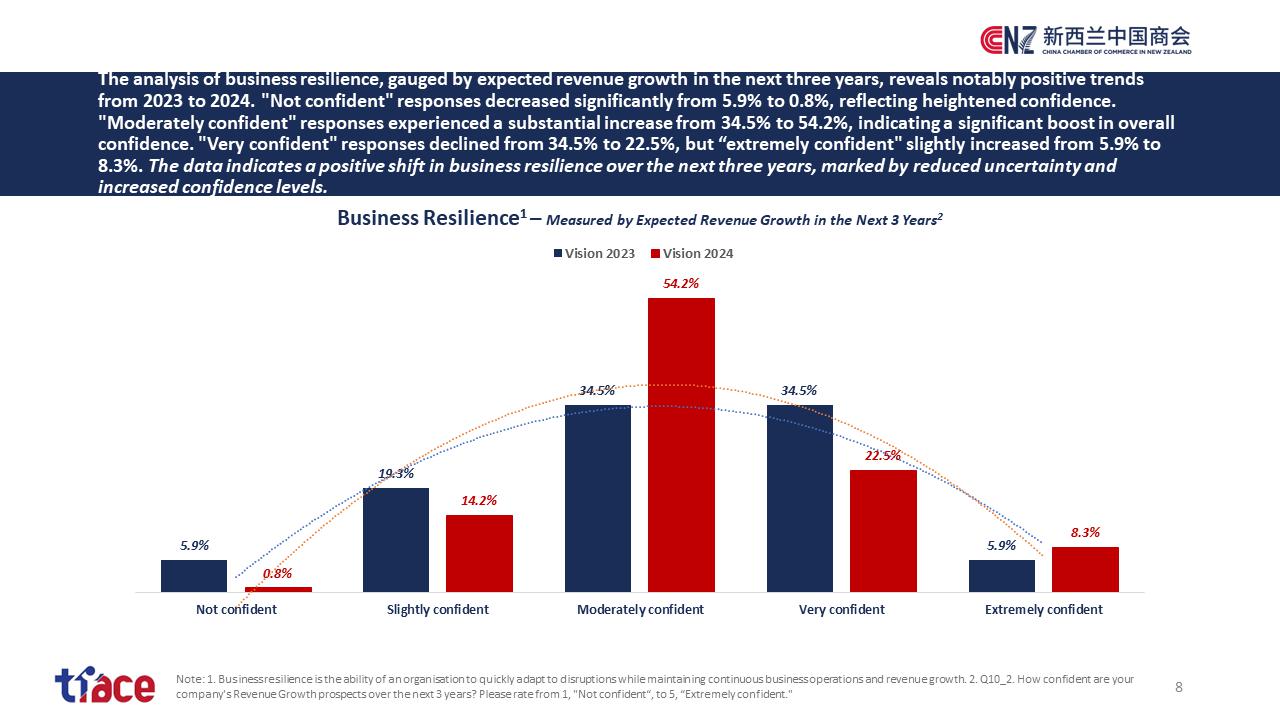

The analysis of business resilience, gauged by expected revenue growth in the next three years, reveals notably positive trends from 2023 to 2024. "moderately confident" responses experienced a substantial increase from 34.5% to 54.2%, indicating a significant boost in overall confidence.

以未来三年预期收入增长来衡量的业务弹性分析揭示了 2023 年至 2024 年的显着积极趋势。“中等信心”的回答从 34.5% 大幅增加到 54.2%,表明整体信心显着提升。

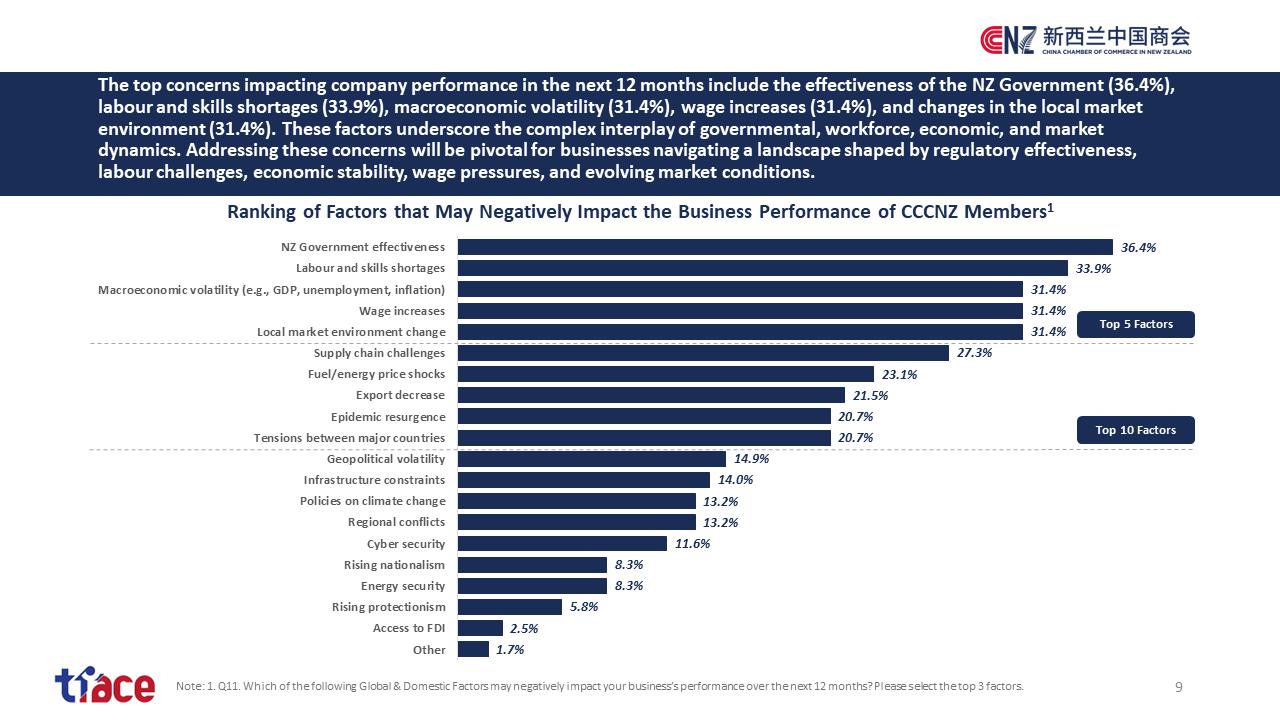

Understanding the concerns impacting company performance is crucial for effective governance. The survey underscores that factors such as the effectiveness of the NZ Government, labour and skills shortages, macroeconomic volatility, wage increases, and changes in the local market environment are top priorities that require strategic attention.

了解影响公司业绩的担忧对于有效治理至关重要。 调查强调,新西兰政府的效率、劳动力和技能短缺、宏观经济波动、工资上涨以及当地市场环境的变化等因素是需要政府层面的战略关注的首要任务。

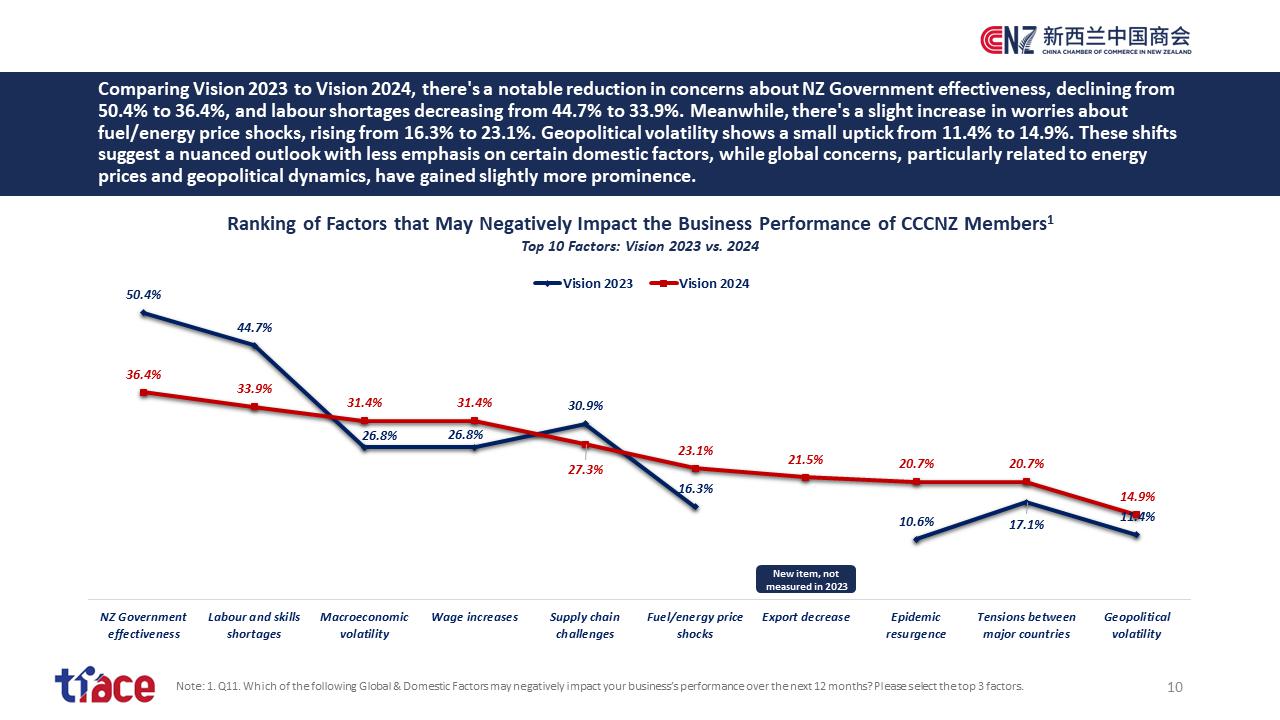

Comparing Vision 2023 to Vision 2024, there's a notable reduction in concerns about NZ Government effectiveness, declining from 50.4% to 36.4%, and labour shortages decreasing from 44.7% to 33.9%. Meanwhile, there's a slight increase in worries about fuel/energy price shocks, rising from 16.3% to 23.1%. Geopolitical volatility shows a small uptick from 11.4% to 14.9%. These shifts suggest a nuanced outlook with less emphasis on certain domestic factors, while global concerns, particularly related to energy prices and geopolitical dynamics, have gained slightly more prominence.

比较《2023新西兰中国商会会员调查报告》和《2024新西兰中国商会会员调查报告》,对新西兰政府效率的担忧显着减少,从50.4%下降到36.4%,劳动力短缺问题从44.7%下降到33.9%。 与此同时,对燃料/能源价格冲击的担忧略有增加,从 16.3% 上升至 23.1%。 地缘政治波动性从 11.4% 小幅上升至 14.9%。 这些变化表明了一种微妙的前景,不再强调某些国内因素,而全球担忧,特别是与能源价格和地缘政治动态相关的担忧,则变得更加突出。

In conclusion, the Vision 2024 survey offers us a compass to navigate the challenges and opportunities ahead. As we chart the New Zealand-China economic cooperation course, let us leverage these insights to foster resilience, collaboration, and adaptability. Together, we can build a future that benefits both nations and enhances the prosperity of our people.

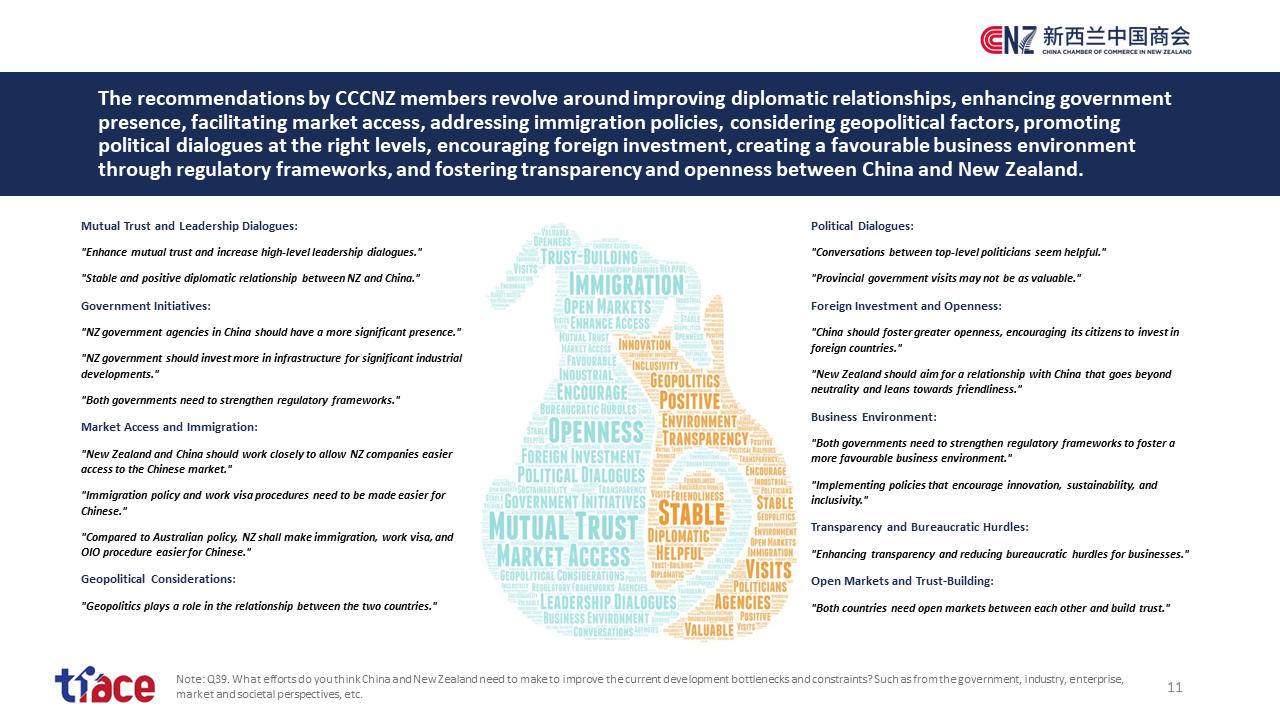

在调查即将结束时,成员们被问及如何采取措施来克服中国和新西兰当前的发展挑战。建议包括加强外交关系、增加政府参与、简化市场准入、重新审视移民政策、考虑地缘政治因素、促进适当级别的政治对话、促进外国投资、通过监管框架建立有利的商业环境以及促进两国之间的透明度和开放性。

总之,《2024新西兰中国商会会员调查报告》调查为我们提供了应对未来挑战和机遇的指南针。 在我们制定新西兰-中国经济合作路线时,让我们利用这些见解来增强韧性、协作和适应性。 我们可以共同建设一个造福两国、促进两国人民繁荣的未来。

END